Reflections on 2025 at FET

Merry Christmas and see you all in 2026

Thank you all for your continued support.

A year ago, I sent this email to my then 5,800 subscribers with a Christmas update.

Looking back now, I realise what a busy year 2024 was—not only in terms of professional output, but in my personal life. It was a year of multiple deaths in the family and a few amongst friends.

This year has been different. More reflective. More focus on the personal and family. Adding to the sense of a life turning point, my eldest son finished school this year.

The whole midlife crisis thing is beginning to make a lot of sense to me. What’s the point of spending time and energy articulating coherent economic analysis when demand for it is so niche?

Expect more reflection in 2026.

How is FET doing? Paid subscribers are now hovering at 220 — a special thanks to you all. Total subscribers are around 6,900 and growing steadily. Up 1,100 in the year.

As I noted last year, I planned to give myself two years of writing to see what audience I could attract. I am two years in now. Things are slower than I had hoped, but the quality of the audience here is very high, and this motivates me. My plans to host economics workshops and in-person events were essentially put on hold this year, but I am gearing up for the first half of 2026. Email me if that interests you or your organisation (but expect a slow response as I am travelling until 6th Jan).

Any help to grow FET by sharing articles on your preferred social media or by emailing your mates is very much appreciated. You can even give a gift subscription.

What have I contributed in 2025?

12 deep dive articles for paid FET supporters

16 free FET articles (thank you to all guest writers)

Dozens of media appearances (including SBS Insights)

Presented on resource royalty pricing at the Australian Conference of Economists

Wrote a report for Shelter NSW illustrating some unappreciated inclusionary zoning economics

I’ve also been on numerous trips to Saudi Arabia to teach in the executive education program at MBSC. Doing this fly-in-fly-out work over the past few years has allowed me to experience the rapid and positive economic and social change taking place there. This work started as a massive burden—the travel, the preparation, and the high demands of large classes with all-day experiential teaching—but has now become a highlight of my year. If any readers are in Riyadh, please get in touch to meet up sometime.

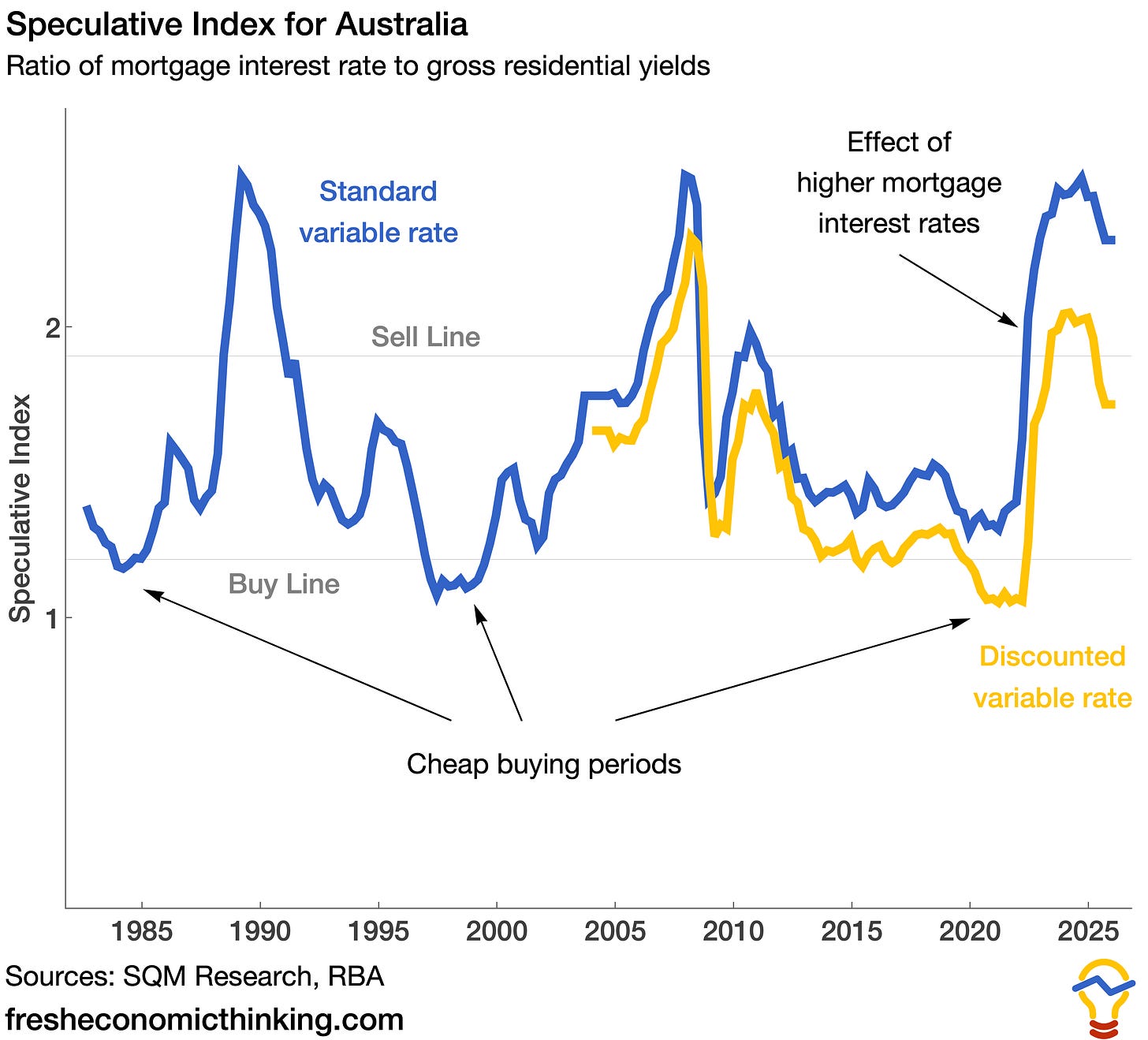

Before I share the top ten most-read FET articles of 2025 and wrap up the year, I wanted to share an update on the Speculative Index, which measures the degree of cyclical over- and under-valuation in the housing market. It is the ratio of the mortgage interest rate to the gross yield of housing. A higher ratio means that the rent is covering less of the return given up by buying housing (e.g. the mortgage interest), and therefore the purchases in these conditions must be justified by expectations of rising prices or rents in the future. When the index is low, it means that rent covers more of the return given up, and so little growth is needed to justify prices at their current levels. Hence the name Speculative Index.

We see very clearly the cycle in property markets and the overvalued periods in the late 1980s, the late 2010s, and today. This is quite normal cyclical behaviour. Undesirable? Probably, like the business cycle in general.

But we are already seeing that rising rents and lower mortgage rates are adjusting us back to less over-valued in the past year or so. If we trust the cyclical patterns here, we can expect a continuation of 2025 trends with some combination of falling prices, falling interest rates, or rising rents for the next few years.

See you next year, and I appreciate all your support.

Don’t forget to check the FET podcast.

"What’s the point of spending time and energy articulating coherent economic analysis when demand for it is so niche? "

Well, hopeful you enjoy the work for the work's sake as well, and not just how its received.

I have appreciated your work in housing especially. For those of us who never saw what liberalism said it saw, your writings are fresh air that cannot be found anywhere in the US.

We all share the angst that current deregulatory/supply-only housing policy is both an accidental theory that is now empirically failing. How much collateral damage will it do? In particularly it lacks a model that reflects the real economic equilibria that you have written about.

My introspection for the year is to see more deeply how liberalism is failing, not because govt shouldn't be doing the things it tries to do, but because it simply can't do them properly, in no small part because of their complexity, and because, by definition any number of egos > 1 cannot be made to agree on anything. First, do no harm. When I ran for and held office, I told people there were two prongs to policy. Doing the right thing, and doing the thing right. It doesn't matter how right the policy might be if its done wrong.

Thanks for your work. Best luck in future decisions.

Helen Keller said, "Christmas Day is the festival of optimism."

Helen was right! Merry Christmas, Cameron!

https://www.centreforoptimism.com/blog/christmas