Rent control is totally normal price-cap regulation

Bernie Sanders has smashed the Overton window. Rent control is going global.

Unfortunately, this means that the economics 101 brigade has come out in force to smugly Vox-splain their incorrect model of rent control and housing market dynamics.

The Onion’s Vox parody is so spot on I can’t stop laughing pic.twitter.com/Q9oQKFr46P

— 𝐂𝐚𝐫𝐥𝐨𝐬 (@ChuckEChaves) September 15, 2019

Regulating housing rents makes economic sense because homes are attached to land monopolies. Monopolies are inefficient, and regulations can improve outcomes. The two classic regulations are 1) a tax on monopoly super-profits, which is common for mineral and energy resources, and 2) a price cap, which is usually applied to network infrastructure, like rail, electricity, and water. If price caps sound to you a bit like rent control, then you would be spot on. They are rent control.

Rent control is not weird or unusual for regulating monopolies. The weird thing is that land is no longer considered a form of monopoly.

Let me explain how these two classic regulations would work in housing markets to socialise monopoly profits from housing locations.

A super-profits tax would work like this. When a new home is constructed, the owner would be able to seek the market rent. That first year’s market rent would become the regulated price that would attach to that home in a rental database. The home would still be allocated in the rental market using open market prices. But any gap between the market price and the regulated price would be 100% taxed. This is shown in the figure below.

If the market price fell below the regulated price for some reason, that loss would accumulate as a credit against future tax obligations when the market price increased again.

With a super-profits tax system housing resources, including new construction, are always allocated by market prices.

Since the financial crisis, rents have increased by roughly 25% in the United States. A quick guess-timate suggests that around a trillion dollars of rents are paid in the US each year. Had such a tax been implemented ten years ago it would now raise about $250 billion a year with no efficiency loss. In Australia, total housing rents have increased from around $30 billion to $45 billion in that period, meaning a housing super-profits tax would now raise around $10 billion per year (after adjusting for the increased housing stock).

The second way to regulate the land monopoly in the housing market is with price caps (rent controls). Here, the sitting tenant is protected from price increases that are not the result of additional housing investment or renovation but arise due to the favourable location-monopoly of the owner.

As before, market prices match tenants to housing and provide incentives for new construction. However, a sitting tenant is protected from price increases that arise from the location-monopoly. This only works if their tenure is secure, and they cannot be evicted as a way to change the rental price back to the market price.

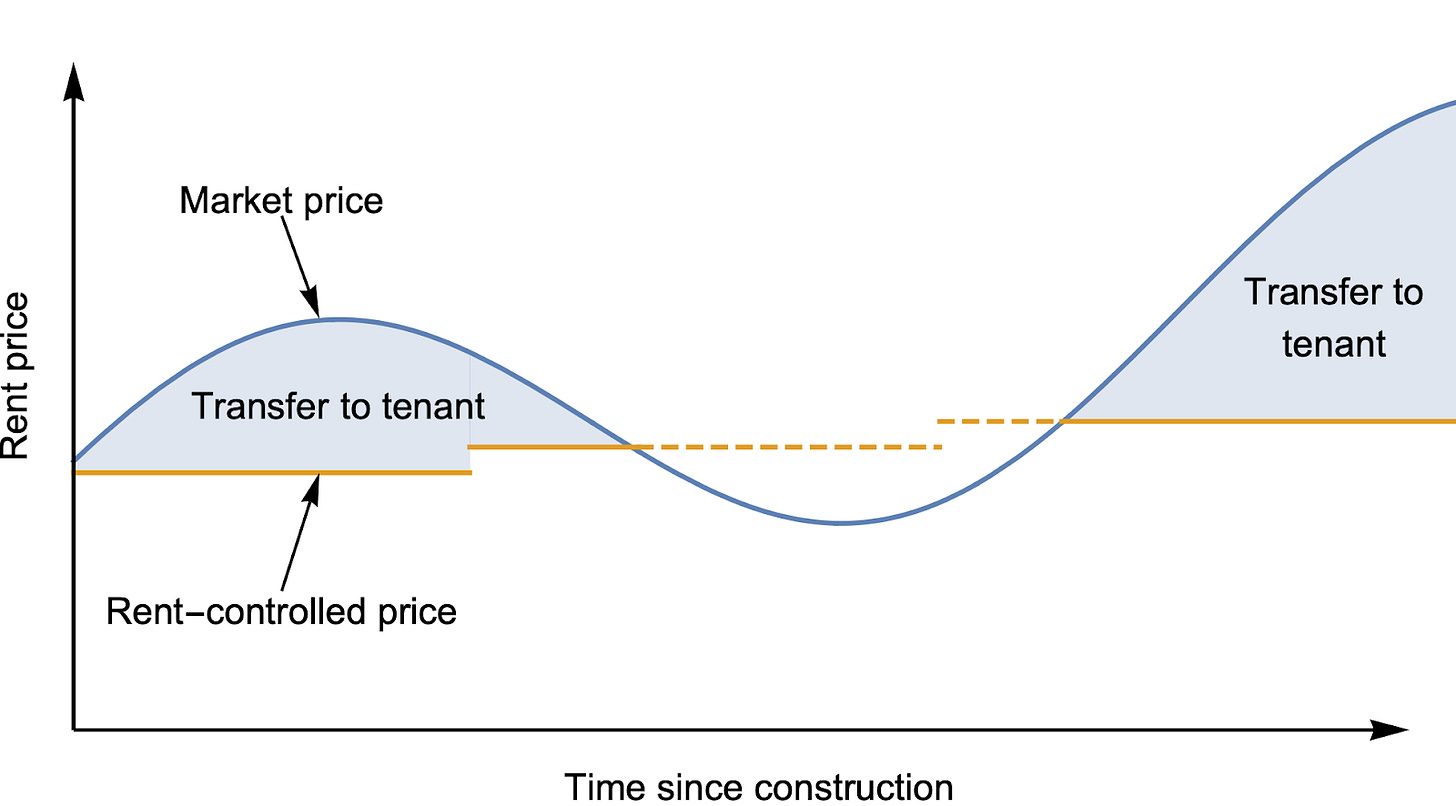

The image below shows how the gap between market price and rent-controlled prices is a transfer to sitting tenants. If market prices fall below the regulated price, the tenant can have the option to renegotiate or move to pay the lower market price. Again letting markets decide resource allocations. It is only in periods of rapid price growth that sitting tenants are protected.

On balance, this type of regulation transfers some monopoly super-profits to tenants in the short-term but gives them back to owners as tenants relocate and homes are again allocated by market prices.

Either system of regulations will socialise some of the monopoly rents in housing markets. In fact, it is widely acknowledged that a reduction in volatility of returns can accelerate new housing investment. Recent studies also show that owners of older housing choose to accelerate redevelopment into more dense housing if their rents are regulated.

Both regulations are common in other monopolistic sectors of the economy. The main issue is that these regulations will transfer billions of dollars of value away from landlords, and landlords won’t like it. And the economic 101 brigade will always find a way to argue that policies to help the poor are bad for them.