Making sense of property as a monopoly

Assuming the property system will act competitively is wrong

Let us start by assuming that the property system is competitive and see how far that gets us in making sense of property pricing. After all, there are many different owners of different locations. That seems like what the textbooks describe.

The competitive market of economic theory has a few quirks. At the firm level, the demand curve is flat. Varying your own supply has no price effect. Yet, at the market level, varying supply does have a price effect. The problem of adding up a bunch of zero effects from firm quantity variation to a positive effect at the market level is an issue. It is resolved by assuming free entry at the market price; if a firm decreases its output while all others retain the same output, a new firm will enter the market and sell exactly that amount necessary to get back to the market equilibrium.

Neat, huh?

So let’s get back to it. We have a bunch of property-owning firms that can redevelop their space into housing. Each property owner sees a flat demand curve at the market price (because of our neat assumption) and has a cost curve that looks like...

Well, what does it look like exactly?

In strictly economic terms, the only input to the property right over a location is the existence of a property system. There are no input costs. To develop housing there are of course costs involved, such as fees, construction, and selling costs. But you can net these costs out of both demand and supply to look at the market for “empty” locations, or property rights to locations. After all, new housing supply is merely the subdivision of space—the subdivision of property rights into smaller pieces. The demand curve is still downward-sloping for that property rights market, but the supply curve must sit at zero.

Here we hit our first problem. If we assume perfect competition, we can only have land (location) prices of zero.

This “zero cost of location” view is what Ed Glaeser argues is the right way to think about housing.

…housing is expensive because of artificial limits on construction created by the regulation of new housing. It argues that there is plenty of land in high-cost areas, and in principle, new construction might be able to push the cost of houses down to physical construction costs.

In other words, land prices should be zero everywhere. Any deviation from this is due to regulatory intrusions in the market. Indeed, this implies that the very existence of a land market with trades at non-zero prices indicates it is not competitive. This is a bizarre conclusion in my view.

Maybe we will have more luck making sense of the property system by assuming it is a monopoly despite the many different owners. This has some intuitive appeal. First, you can’t choose to have your locations supplied by a competing property titles system. You can’t run more than one property system in parallel. Can you imagine the conflicts over who owns what space with multiple property systems? Second, the ownership of monopolies is often carved up (subdivided) and owned by many different people who each own constituent parts. Though we usually call these company shares or stocks.

So what then of the economic theory of monopoly?

As a starting point, a monopoly model avoids the assumption of free entry as the reason individual firms cannot observe their own-supply effect on price. This matches the reality of the private property system as it does not allow free entry. You can only compete in the property market by first buying property from the property market. This seems sensible.

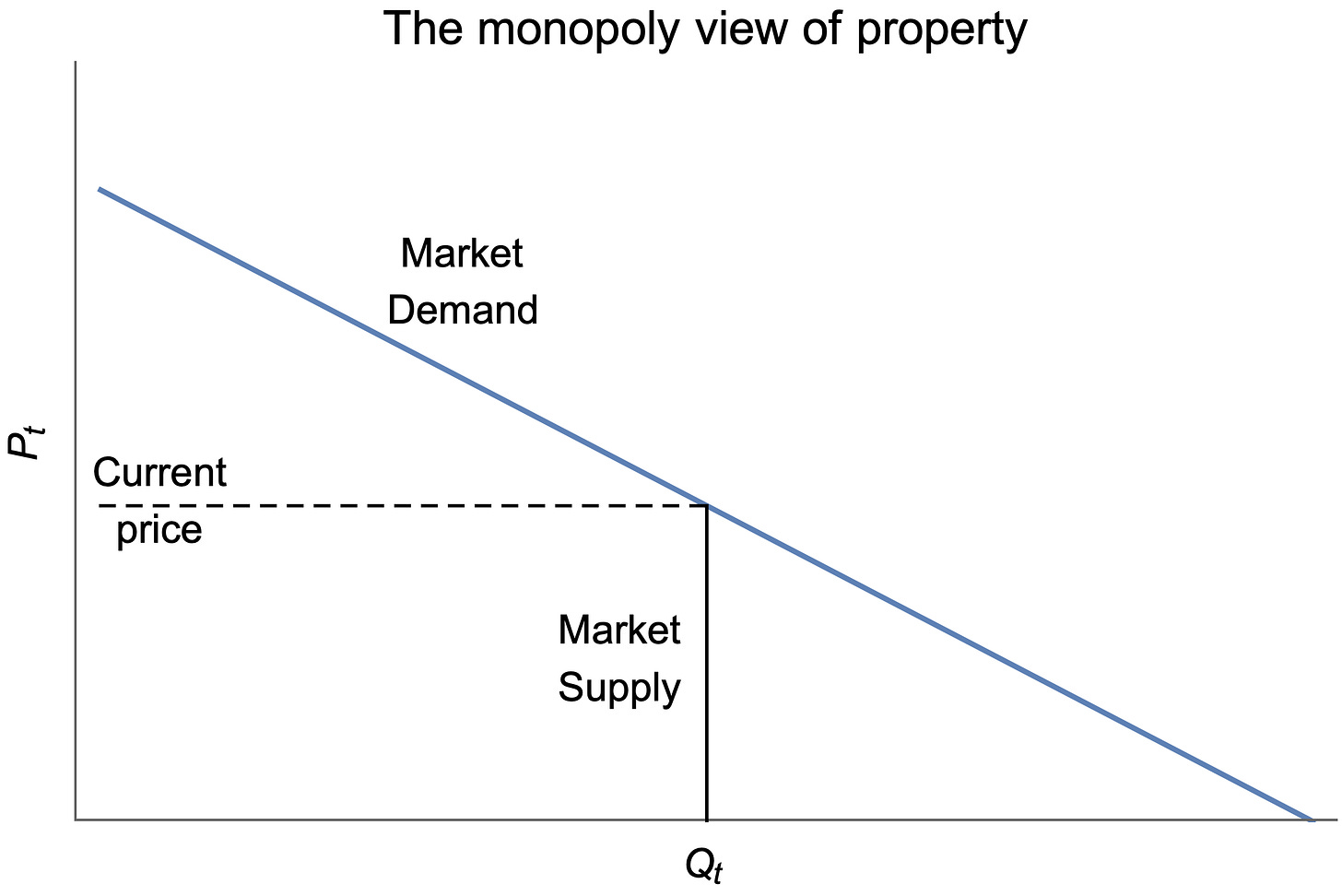

The property market for any use, like housing, therefore looks this at a point in time.

Since costs are all sunk, we can simplify a bit by ignoring the stock of existing housing and look forward in time only. Think about redrawing the axes with the origin at the equilibrium current price and stock.

A change in the housing stock is the supply of new housing. The question of interest is how the stock of housing evolves over time in a property monopoly to determine an equilibrium rate of new supply?

In this model, if demand stays fixed and existing housing does not depreciate, then no new housing is built.

As demand shifts, new supply is added at a rate that maximises the revenue gain from selling those new properties rather than keeping them undeveloped in your balance sheet. It is the same monopoly maximisation principle applied at the margin. In other words, you sell new housing lots at a rate that maximises the present value of that flow of sales.

This logic is shown below. From the t=0 equilibrium, demand shift upwards. The green line shows the marginal revenue from the new supply (i.e. the change in the housing stock, Q, over that period). The new equilibrium is where the revenue from that flow of new property put to housing uses is maximised (i.e. where marginal revenue from that flow is zero).

This equates to a rate of supply that I explain in my absorption rate theory of housing supply (assuming a zero interest rate to simplify the inter-temporal trade-off).

The steeper (more price sensitive) the demand, the less supply responds to the same vertical demand shift. That’s because each property owner is sensitive to their bigger own-supply effect on the market price. Thin markets mean less supply.

Under this monopoly logic, the supply curve for property is not an independently-determined cost curve, but a derived curve based on the slope of the market demand curve.

But how do you get to the monopoly outcome? Is a conspiracy needed? Not at all. All that is needed is trial and error. Remember, unlike the competitive market assumption of free entry, in the monopoly model, changes in firm output affect market output. If firms start near the competitive rate of supply per period in the face of a sloping (and rising) market demand curve, they will quickly learn to get to the monopoly rate of supply independently.

All that is needed is a learning rule of “win-stay, lose-shift”. This rule says that if the increasing the rate of supply last period increased your marginal revenue, then increase next period, otherwise decrease the rate of supply. If decreasing the rate of supply last period increased your marginal revenue, continue to decrease, otherwise increase.

When I simulate this learning rule with three firms, they quickly converge to the monopoly rate of supply, and hence the monopoly price. This convergence will occur even with 1,000 firms in the market. Property markets have been around for a while now. It seems likely that the current set of property owners has learnt this maximising equilibrium.

It seems logical to conclude that the monopoly model of property makes more sense than a competitive model. Indeed, monopoly was the traditional economic way of understanding property markets. In terms of understanding housing markets and effective policies to reduce prices, I think the following points are key.

That the property system is a monopoly shows that the rate of new housing development is mostly a product of demand. Property owners don’t want to build faster. This is because supply is not independent of demand. Supply is merely a reflection of demand.

Rezoning and changing planning rules might change where development happens (as it should—they are location regulations after all) but probably won’t change the rate of new supply. The rate is the one the market wants. Developers don’t want to flood the housing market.

Making housing cheaper should be understood the same way we understand other monopolies. We regulate prices. We create public options. Pretending that we can somehow capitalise on competitive market forces that don’t exist won’t change things.