Evil rent control revisited

When economists study rent control they twist themselves in knots to argue that good outcomes are actually evil.

A new report is out looking at the Berlin experience with rent control (original German report here). The basic idea is that dwellings built prior to 2014 now have regulated rents and caps on rental increases. All very standard price-cap regulation. New dwellings are not regulated.

What I find funny are the contortions that economists make to explain good things as evil things because of their cultural taboo about rent control. With the help of another recent paper on rent control, I want to straighten out some of these contorted arguments.

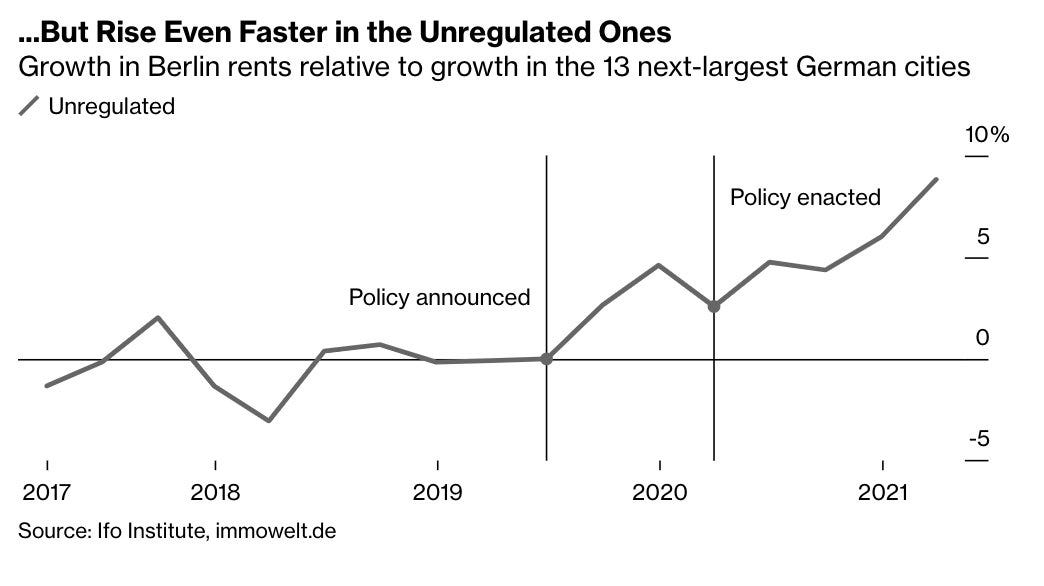

Rents in the unregulated market don’t fall. This is evil.

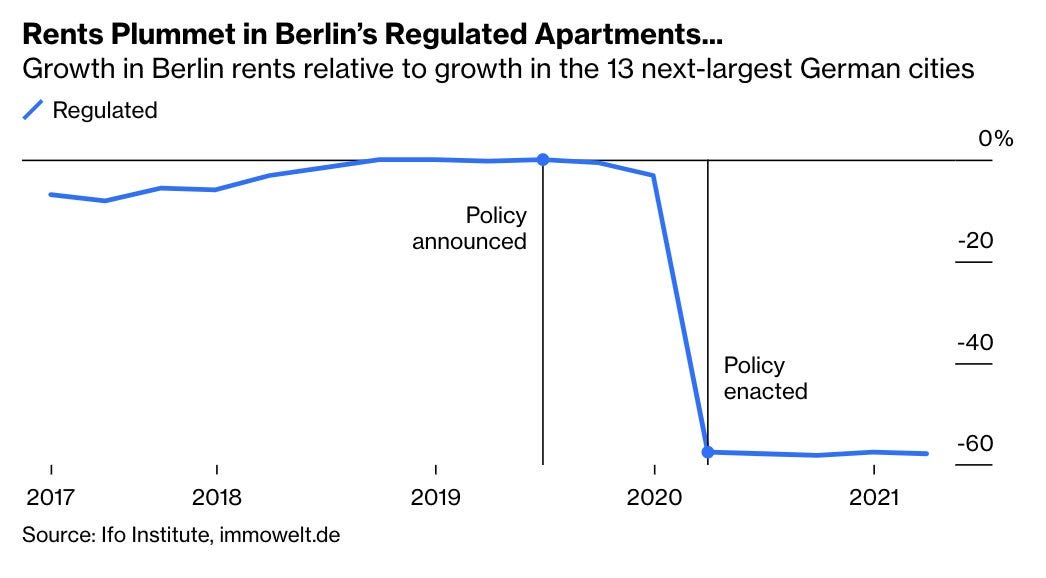

High rents are bad. This is the foundation of the claim that rent control is bad. Yet the enormous benefit of rent growth at a rate 60% less for roughly half of all households in Berlin is ignored and downplayed.

There aren’t many other policy interventions that get this size outcome. Even doubling home building for a decade is at most going to see a 10% relative rent reduction in a decade's time, which in terms of growth rates would be a tiny effect. This rent control case study appears to be one of the most successful affordable housing policies I've ever seen.

Even if you assume that market rental increases of the past year are related to rent-control policy (rather than being a continuation of previous market trends, which my eyeballs tell me is the case, especially in the original report chart with error bars marked) the welfare calculation is hugely in favour of rent control.

The basic welfare calculation is:

With a 0.5 share of households renting pre-2014 buildings with rent rising 2% per year instead of, say 5%, saves each household about half of the current year’s rent over 5 yrs. That’s 0.25 “city rent years” of benefit to residents.

With a 0.05 share of households relocating each year paying at worse 0.08 more for their rent, we get 0.027 of “city rent years” of cost to residents over 5 yrs.

On pure "high rent is bad" benefit-cost terms the Berlin experience got a 10x economic return! This even assumes that all private market rental growth is due to rent control, which is implausible (more on new supply later).

You can’t just pretend that these orders of magnitude are similar.

Additionally, the macro-economic effects of additional non-housing renter spending in the local economy must be quite large. This is a diversion of a large chunk of the rents in the city from landlords to tenants, with the downwards income distribution likely having large spending effects.

Landlords sell to homeowners. This is evil.

“Landlords treated by rent control reduce rental housing supplies by 15 percent by selling to owner-occupants and redeveloping buildings.”

I find this statement hilarious. Landlords sold to owner-occupants. This is a good thing, not an evil thing.

Many policies are aimed at getting more homeownership and the best way to do that is for landlords to sell to owners (even the tenant perhaps). If they do this, there is no effect on the supply of dwellings. This is because the former renter who buys the home is now also no longer a renter. It’s a minus one from the supply AND a minus one from the demand.

Redeveloping buildings increases new housing supply. This is evil.

The whole economic schtick about rent-control is that it decreases new housing supply. But both the Berlin report and the Diamond et. al. paper show this is not the case.

Diamond shows that rent-controlled housing is roughly 5% more likely to get additions and alterations, and 7% more likely to be redeveloped. But I thought rent control meant that landlords won’t invest in their buildings anymore? The charts below show these effects over time.

In fact, there is a whole movement of economists and urbanists who are itching for ways to get more housing supply because they believe it helps reduce the cost of renting in prime areas. Maybe try rent control?

Turning now to the supply of unregulated rental housing advertised in the market, it looks from the Berlin study that new apartment listings are outpacing peer cities. But this is labelled evil. They are "only slightly outpacing" other cities. Terrible!

Rent control stops poor people from being displaced. This is evil.

The final strange contortion happens in the Diamond paper when concerns over low supply (now invalidated) turn into concerns over gentrification and the rapid new supply of luxury market-priced housing. That rent-control works to stop the displacement of poor people during this process is then labelled as evil by saying that it widens income inequality.

…it appears rent control has actually contributed to the gentrification of San Francisco, the exact opposite of the policy’s intended goal. Indeed, by simultaneously bringing in higher income residents and preventing displacement of minorities, rent control has contributed to widening income inequality in the city.

The problem with rent control is that it works. This is evil.

The real issue is not that rent-control is an economic failure. The zeal with which the theoretical economic case against it is made, regardless of the evidence, is necessary because rent-control works. Without an economic story for why rents should not be regulated, all those landlords would constantly face the political risk of losing billions in rents.

One argument that I’ve heard is that economists have tricked themselves with their own supply and demand theories. But I think that’s wrong. I argue that the theory is used to back-fill a convenient political story. I say that because supply and demand logic can just as easily be used to show why rent-control should be a huge success with no changes to investment incentives around new housing.

Let me show you. In the first supply and demand diagram below I include total housing supply and demand, with a kinked supply curve to represent the existing stock of dwellings that don’t get demolished because prices might fall. This the way Ed Glaeser describes housing supply curves.

All we then do is split the demand curve into existing and new demand. We subtract out the tenants of existing houses from new demand, and their existing homes from new supply, and are left with the following, where the dashed blue line is the demand curve for existing housing and the solid blue line is the demand curve for new housing. It’s the same equilibrium. We merely cut off all demand and supply to the left of the market equilibrium and put it in the regulated system.

The economics of rent control is evil.

The taboo topic of rent control is so screwed up that the evidence it works must be contorted into something evil.

And that's all folks.

Generalities to the point of obscurity. Explain how the Berlin system works and why it does not discourage housing supply. Why would some landlords not sell to owners and move onto other enterprises? Maybe address the root cause of the problem which is pursuit of endless cancerous growth by politicians prostituting themselves to developers regardless of how unlivable an endlessly sprawling megalopolis becomes.

Generalities to the point of obscurity. Explain how the Berlin system works and why it does not discourage housing supply. Why would some landlords not sell to owners and move onto other enterprises? Maybe address the root cause of the problem which is pursuit of endless cancerous growth by politicians prostituting themselves to developers regardless of how unlivable an endlessly sprawling megalopolis becomes.