Another superannuation lie

It doesn't smooth lifecycle income. It makes you poorer when you are young and poor and richer when you are old and rich.

Here’s a look at my super balance from a month back.

In the past couple of years, next to nothing but fees and losses.

I could have used the extra money in the two years, with a young family and a mortgage. I am in my peak spending years, but not yet in my peak earning years.

The thing is, compulsory superannuation doesn’t do one of the main things it is claimed to do of smoothing out your lifetime income. We pretend that the super system subtracts from your spending power when you have a high income, and adds to it when you have a low income.

But that’s not what it does.

It subtracts from your income when you are young, regardless of your income level, and gives back when you are old, irrespective of your income level.

Let me try and make this point very clearly with the help of the diagram below.

The diagram shows the economic resources available for spending each year over a lifetime in blue from age 0 to age 90 for a typical household. The line I simply made up to reflect common lifecycle stages, with a bit of random variation, and you are welcome to think about how your own access to economic resources has changed over your life.

Obviously, as a child, your economic resources depend on your parents. In your 20s, you would typically have a relatively low income, with few assets and savings to draw on.

In your 30s and 40s, you likely have a higher income but also are likely to have a family and hence on a household-size adjusted basis, you gain economic resources and spending power slowly.

Then there is the stage between kids leaving home and retirement proper. These are often your best income earning years, with your lowest expenses, like kids to support, home deposits to save, and so forth.

When you look at a lifecycle this way you see that for a fair chunk of it, you are worse off economically than what you can expect to be in retirement. Here this happens all the way up to age 40-something.

From an individual perspective, the super system only shifts spending power forward in time. Mostly it shifts it to ages 59-67, the peak earning years of many people and the most likely ages to receive an inheritance, and before age pension eligibility.

I show in the dashed orange line how compulsory superannuation reduces spending power during those young years when it was already below what it would be in retirement.

In short, super doesn’t smooth out your lifecycle income by redistributing from high-income years to low-income ones. It makes your lifecycle income more variable by shifting from low-income years into high-income ones.

The super lobby doesn’t care

An interesting report came out recently from Choice showing that you only need $88,000 in superannuation to have a comfortable retirement if you own your own home and only $111,000 for a couple.

Good to know I’m already at that level with my super.

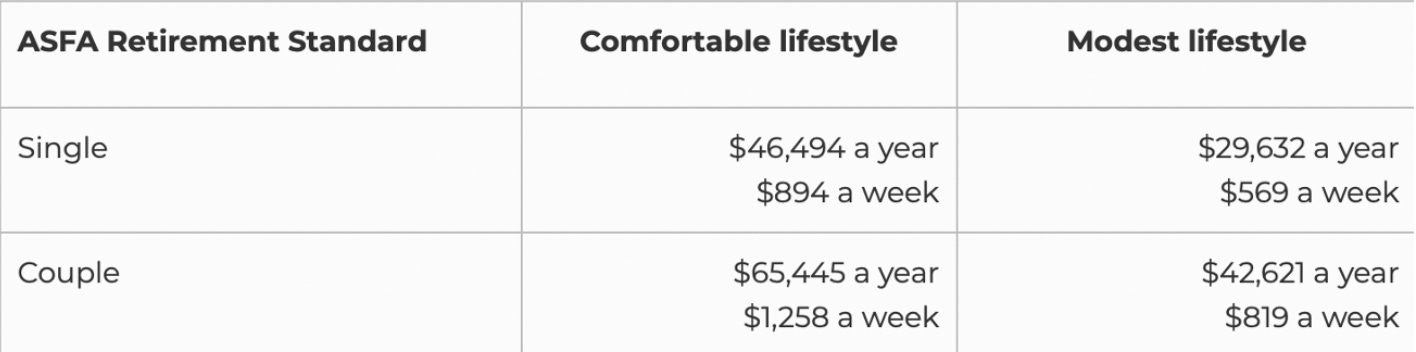

SMH columnist Jessica Irvine responded with an article comparing her family’s annual spending during their peak years of income and expenses, of $88,000-$90,000 per year, to that of the super industry’s “comfortable retirement standard”.

You see, the super lobby thinks that to have a comfortable retirement you need $65,000 per year in disposable income as a homeowner couple. This is nuts, and far higher than most households have during their peak income years.

After Jessica’s $42,000 in mortgage costs and school fees, she is spending far less than a “comfortable” retiree, with more people in her household, during her peak earning years.

Why would she want to be poorer now so she can be richer later? Even for households like Jessica’s and mine, who have good working life incomes, super makes little sense in terms of smoothing your lifecycle spending power.

When this is true as it is for a lot of people - that is the over saving problem - the Super system ends up as an inheritance subsidy. That's engineering a type of society that is widely considered to be undesirable. In the mid 20th century the rationale for inheritance taxes was that inherited wealth should not play a large role in society. The role of wealth in Australia is increasing and I for one don't think this is a good thing!

I recognise that I actually 'feel good' about the fact that I have a somewhat ok super balance, which may be part of why everyone supports the super system. I think we may have all bought into the 'Keating is a legend fallacy' (because he's funny - no other actual reason) without understanding the full implications of our super system. The opportunities for rorting the super system are a big turnoff with it. This blog post I read a little while ago, or I listened to a podcast with you on super, and it's changing my thinking on super. One thing I do like about super is that it's like encouraging a form of public ownership of the means of production - everyday Australians benefit from the rise in profits. However this of course likely has political implications with people opposing corporate tax increases and still the largest proportion of people with shares being rich, so basically exacerbating income inequality.